When you convert your traditional bicycle using an e-bike conversion kit, insurance requirements become a crucial consideration that many riders overlook until problems arise. Whether insurance is mandatory, recommended, or unnecessary depends entirely on your location, the power of your system, and how you use your converted e-bike.

Understanding these regional requirements protects both your investment and your legal standing should accidents occur.

The Insurance Question: Why It Matters

Beyond Legal Compliance

Insurance for e-bikes serves multiple purposes beyond satisfying legal requirements:

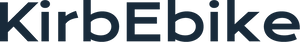

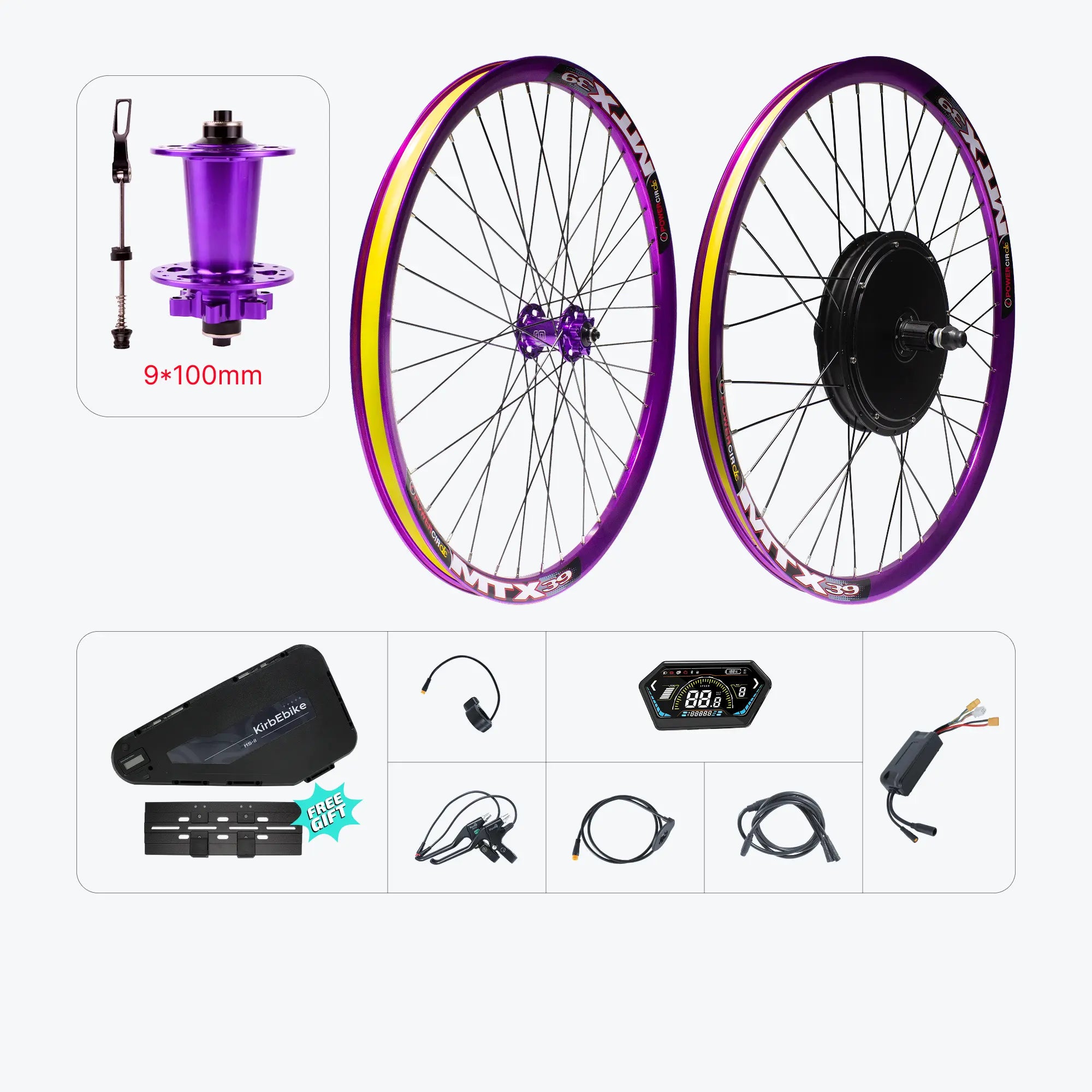

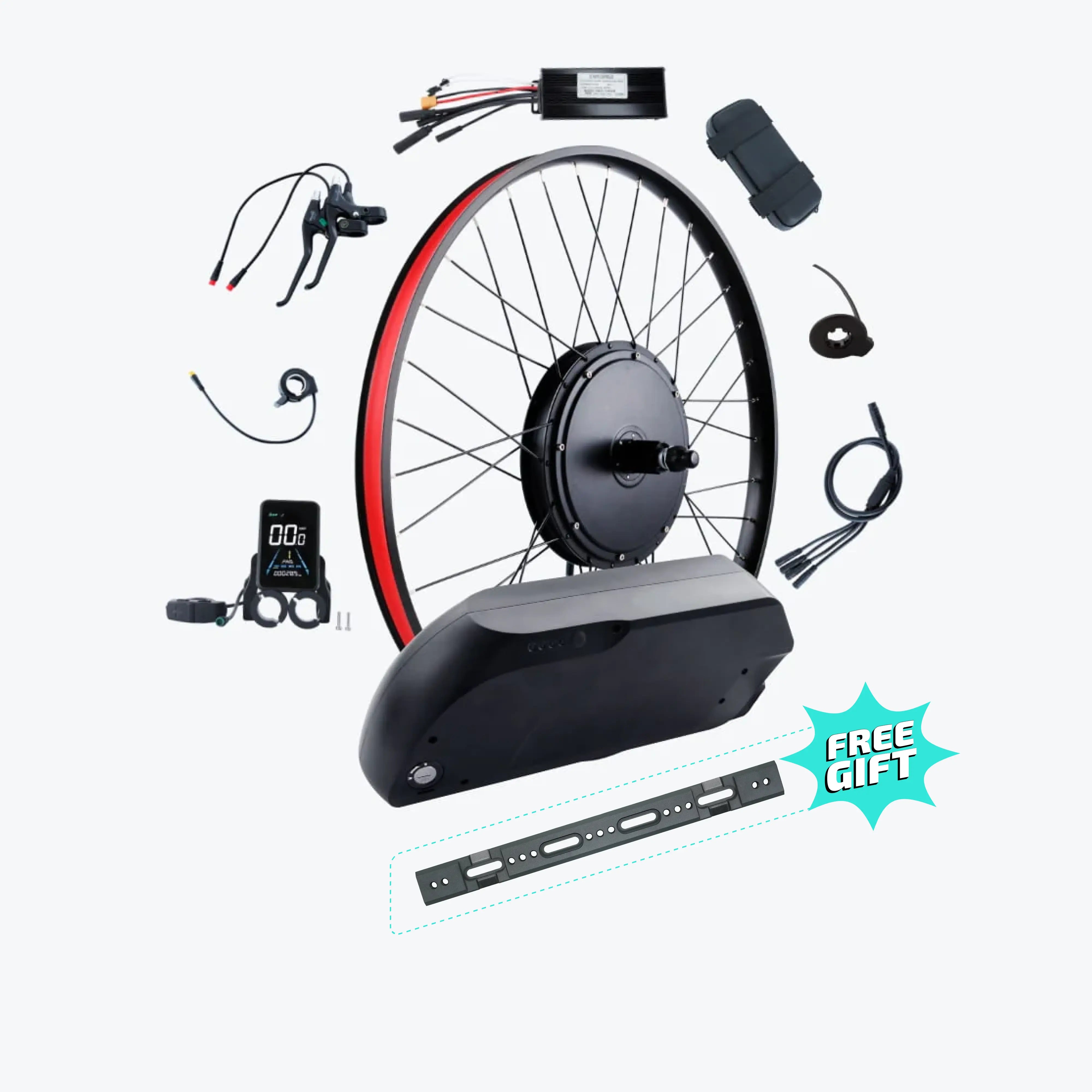

Financial Protection: E-bike conversion kits represent significant investments. Quality systems with batteries, controllers, and displays can cost several hundred pounds or dollars. Insurance protects this investment against theft, damage, and loss.

Liability Coverage: Perhaps more importantly, insurance covers your liability if you injure someone or damage property while riding. Medical bills and property damage claims can reach tens of thousands in costs.

Peace of Mind: Knowing you're protected allows you to enjoy riding without constant worry about "what if" scenarios.

Legal Defense: If involved in incidents leading to legal action, insurance typically covers legal representation costs.

United Kingdom: Clear Distinctions

EAPCs: No Insurance Required

In the United Kingdom, legally compliant Electrically Assisted Pedal Cycles (EAPCs) do not require insurance by law. If your conversion meets these criteria, insurance remains optional:

UK EAPC Requirements:

- Maximum 250W rated motor power

- 15.5 mph (25 km/h) assistance cutoff

- Pedal-assist operation only

- Throttle limited to 6 km/h walk-assist

The EZ Rider Kit exemplifies this compliant category with its 36V 250W motor and 15 mph maximum speed, requiring no mandatory insurance for road use.

|

System Type |

Insurance Required? |

Additional Requirements |

|

Compliant EAPC (250W, 15.5mph) |

No |

None |

|

Non-compliant e-bike |

Yes |

Registration, license, MOT |

|

High-power conversion (1000W+) |

Yes |

Full motor vehicle compliance |

When UK Insurance Becomes Mandatory

Installing a conversion kit exceeding legal EAPC limits transforms your bicycle into a motor vehicle, triggering mandatory insurance requirements:

Systems Requiring Insurance:

- Motors exceeding 250W rated power

- Assistance beyond 15.5 mph

- Throttle operation above 6 km/h

- Any combination of non-compliant features

Required Coverage Types:

- Third-party liability (minimum)

- Road traffic insurance certificate

- Valid continuously while vehicle capable of use on roads

Voluntary Insurance for UK EAPCs

Even when not legally required, many UK riders choose insurance for compliant e-bikes:

Home Insurance Extensions: Many home insurance policies can extend to cover e-bikes for theft and damage, though coverage varies significantly. Check whether your policy covers:

- E-bikes specifically or just "bicycles"

- Conversion kits or only complete manufactured e-bikes

- Value limits (often £1,000-2,000)

- Away-from-home coverage

- Component theft (batteries particularly vulnerable)

Specialist E-Bike Insurance: Several UK insurers now offer dedicated e-bike policies covering:

- Theft and attempted theft

- Accidental damage

- Component theft (batteries, displays, motors)

- Public liability coverage

- Legal expenses

- Personal accident cover

European Union: Country-by-Country Variations

General EU Framework

The European Union harmonized basic e-bike regulations through EN 15194, but insurance requirements remain a national competence with significant variation.

Standard EU E-Bike Definition:

- 250W continuous rated power maximum

- 25 km/h assistance cutoff

- Pedal-assist operation only

Country-Specific Insurance Requirements

Germany:

Germany maintains relatively straightforward requirements aligned with EU standards.

Insurance Status:

- Compliant pedelecs (250W, 25 km/h): No insurance required

- S-Pedelecs (up to 4kW, 45 km/h): Mandatory insurance, registration, and license plate

- Higher-power systems: Full motor vehicle insurance required

Voluntary Coverage:

- Household insurance often covers e-bikes to certain value limits

- Specialized bicycle insurance widely available

- Liability coverage sometimes included in personal liability insurance

France:

French regulations require attention to both e-bike classification and insurance implications.

Insurance Requirements:

- Standard e-bikes (250W, 25 km/h): No mandatory insurance, but civil liability coverage required (usually through home insurance)

- Speed pedelecs: Moped insurance mandatory

- All riders must have civil liability coverage regardless of vehicle type

Netherlands:

The cycling-friendly Netherlands has well-developed e-bike infrastructure and insurance markets.

Insurance Landscape:

- Standard e-bikes: No mandatory insurance

- Speed pedelecs: Registration and insurance required

- Very high insurance adoption rate voluntarily

- Comprehensive policies readily available and affordable

Spain:

Spanish requirements vary by autonomous region, creating complexity.

Regional Variations:

- Some regions require registration even for compliant e-bikes

- Insurance requirements follow registration status

- Third-party liability generally recommended

- Check specific regional requirements

Italy:

Italy follows EU standards with additional clarifications.

Insurance Requirements:

- Pedal-assist e-bikes to 25 km/h: No insurance required

- Higher-speed or power systems: Moped classification and insurance

- Many riders carry voluntary liability coverage

United States: State-Level Complexity

Federal Perspective

At the federal level, the Consumer Product Safety Commission regulates e-bikes as consumer products, not motor vehicles. This means no federal insurance mandate exists for compliant e-bikes.

Federal E-Bike Definition:

- Motor power of 750W or less

- Maximum speed of 20 mph on motor power alone

- Operable pedals required

State-by-State Insurance Status

No States Currently Require E-Bike Insurance: Unlike motor vehicles, no US state currently mandates insurance for e-bikes that meet federal or state class definitions. This applies to:

- Class 1 e-bikes (pedal-assist to 20 mph)

- Class 2 e-bikes (throttle to 20 mph)

- Class 3 e-bikes (pedal-assist to 28 mph)

Liability Exposure Despite No Mandate

The absence of mandatory insurance doesn't eliminate liability exposure. US riders face significant financial risk without coverage:

Potential Costs Without Insurance:

- Medical bills for injured parties: $10,000-100,000+

- Property damage: $1,000-50,000+

- Legal defense costs: $5,000-50,000+

- Pain and suffering claims: Variable, potentially substantial

- Lost wages for injured parties: Ongoing costs

US Insurance Options

Homeowner's or Renter's Insurance: Most policies include personal liability coverage that extends to bicycle operation, including e-bikes. However:

- Coverage limits vary (typically $100,000-300,000)

- May exclude "motorized vehicles" in some policies

- Check specific policy language regarding e-bikes

- Typically provides no theft or damage coverage for the bike itself

Umbrella Liability Policies: These supplement basic homeowner's coverage with additional liability protection:

- Typical coverage: $1,000,000-5,000,000

- Relatively affordable supplemental protection

- Covers e-bike operation in most cases

- Provides defense costs in addition to settlement amounts

Specialized E-Bike Insurance: Growing market of dedicated e-bike insurance policies offering:

- Theft and damage coverage

- Liability protection

- Medical payments

- Accessory coverage (batteries, displays, etc.)

- Crash replacement

Bicycle-Specific Policies: Companies like Velosurance, Markel, and others offer comprehensive bicycle insurance including e-bikes:

- Agreed value or replacement cost

- Racing and competition coverage options

- Worldwide coverage in many cases

- Covers conversion kits and components

Filing Claims: What to Know

Documentation for Insurance Claims

Whether claiming theft, damage, or defending liability, proper documentation proves essential:

Before Incidents:

- Photographs of complete converted bike

- Receipts for all conversion components

- Serial numbers for motor, battery, and bike frame

- Installation documentation or professional installation receipts

- Regular updated photos showing condition

After Incidents:

- Police reports for theft or accidents

- Witness statements if available

- Photographs of damage

- Medical documentation if injuries involved

- Communication records with other parties

Common Claim Pitfalls

Undeclared Modifications: Failing to inform insurers about conversion can void coverage entirely. Always declare conversion kits explicitly.

Inadequate Security: Many policies require specific security measures (locks of certain ratings). Failure to meet these voids theft claims.

Excluded Use: Using e-bikes for commercial purposes (deliveries, etc.) often excluded from personal policies.

Component vs. Complete Bike: Some policies cover "the bicycle" but exclude components. Batteries stolen separately may not be covered.

Conclusion

Insurance requirements for e-bike conversion kits vary dramatically by region, with mandatory coverage required in the UK and EU only for systems exceeding standard limits, and no mandatory insurance in the United States regardless of system specifications.

However, legal requirements tell only part of the story—the potential liability exposure and investment protection considerations make insurance advisable for most riders regardless of legal mandates.Whether you've installed a compliant 250W system or a more powerful conversion kit, carefully evaluating your insurance needs protects both your financial interests and peace of mind.

Frequently Asked Questions

Will my home insurance automatically cover my e-bike conversion kit?

Not necessarily. Many home insurance policies cover bicycles to limited amounts, but may exclude "motorized vehicles" or specifically not cover conversion kits. Contact your insurer directly, explain exactly what you've installed, and obtain written confirmation of coverage or exclusions.

If insurance isn't legally required in my area, why should I consider it?

Legal requirements address minimum standards, not optimal protection. Without insurance, you're personally liable for any injuries or damage you cause, potentially costing tens of thousands. Additionally, your conversion kit investment remains unprotected against theft or damage without coverage.

Does installing a higher-power conversion kit (1000W+) make insurance impossible to obtain?

It becomes more challenging but not impossible. Standard e-bike policies typically exclude systems exceeding legal limits, and motorcycle insurers often refuse coverage for bicycle-based conversions. However, some specialty insurers offer custom policies. Your homeowner's liability may still apply depending on specific policy language.

Can I get insurance that covers only theft of my battery and motor, not the whole bike?

Some specialized e-bike insurance policies offer component-specific coverage or allow you to specify high-value items separately. This can be more cost-effective than insuring the entire bike. Check with providers offering e-bike-specific policies rather than general home insurance extensions.

What happens if I'm in an accident on an uninsured e-bike in a region where insurance is mandatory?

You face multiple serious consequences: personal liability for all damages and injuries, fines for operating without insurance, potential criminal charges, and difficulty obtaining insurance afterward. Additionally, if the other party has uninsured motorist coverage, their insurer may pursue you directly for costs.

Do I need different insurance for a mid-motor conversion vs. a hub motor conversion?

Generally no—insurance focuses on the bike's overall power, speed capabilities, and value rather than specific motor types. However, mid-motor conversions like the Tongsheng TSDZ8 may have higher values due to more complex installation, potentially affecting premium amounts but not coverage eligibility.

If I only ride my high-power conversion kit on private property, do I still need insurance?

Legal insurance mandates typically apply to public road use. Private property use doesn't trigger mandatory insurance in most regions. However, liability exposure still exists if you injure someone or damage property, even on private land. Consider whether your homeowner's policy provides adequate liability protection for this use case.