Electric bikes are increasingly popular across the UK, offering commuters an eco-friendly, cost-effective, and fun alternative to traditional transport. With the rise of home-working, green commuting incentives, and urban congestion, many people are asking: are electric bikes tax deductible?

This article will explore the tax advantages of electric bikes, their eligibility in the UK, and how KirbEbike conversion kits can make your existing bike tax-friendly.

What Makes an E-Bike Tax Deductible?

In the UK, the government provides tax incentives for eco-friendly transportation, including electric bikes, under schemes like the Cycle to Work program. These schemes are intended to reduce carbon emissions and encourage healthier commuting.

To be eligible for tax relief, your electric bike must meet certain requirements:

- Maximum assisted speed of 25 km/h (15.5 mph)

- Pedal-assist only, no throttle-only operation

- Power limit under 250W for most schemes

KirbEbike conversion kits, such as their 48V 1000W or 52V 2000W kits, can often be tailored to comply with UK regulations, making them a flexible option for turning your traditional bike into a potential tax-deductible e-bike.

Benefits of Tax-Deductible E-Bikes

Owning a tax-deductible electric bike offers multiple advantages:

- Financial Savings – Salary sacrifice schemes reduce your taxable income when buying an e-bike.

- Health Benefits – Pedal-assist systems provide exercise without overexertion.

- Eco-Friendly Travel – Reduce carbon emissions compared to cars.

- Flexibility – Kits like KirbEbike allow you to convert any bike to meet tax scheme criteria.

- Ease of Commuting – Avoid traffic jams and expensive parking fees.

KirbEbike’s range of conversion kits with battery, including their 48V 1000W and 72V 2000W options, ensures riders can customize power output and speed limits to adhere to UK tax regulations while enjoying the benefits of e-mobility.

How KirbEbike Makes Your Bike Tax-Friendly

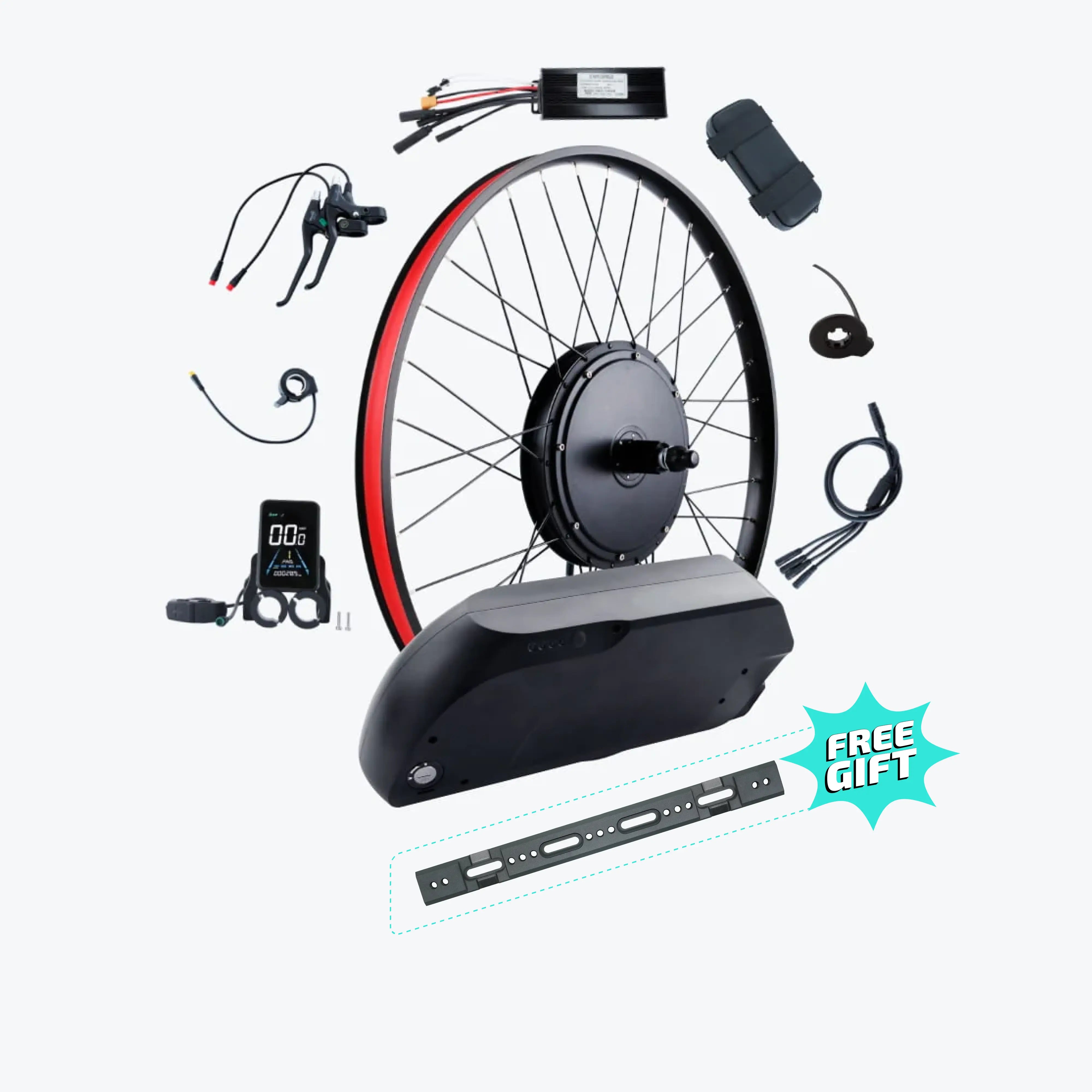

KirbEbike offers easy-to-install conversion kits that turn almost any traditional bike into a high-performance e-bike. Their kits include:

- Brushless hub or mid-drive motors

- Lithium batteries (16Ah–30Ah)

- LCD displays with speed and battery monitoring

- Pedal Assist System (PAS) for regulated power

The PAS system is crucial for tax schemes because it ensures that electric assistance cuts out at the legal 25 km/h limit, keeping the e-bike compliant with UK regulations. Additionally, KirbEbike provides customizable controllers so you can adjust power and speed settings according to local laws.

Comparing Electric Bikes vs Conversion Kits for Tax Relief

When considering tax-deductible options, there are two main approaches:

- Buying a Pre-Built Electric Bike – Many models already comply with UK rules and can be purchased through cycle-to-work schemes.

- Using a Conversion Kit – KirbEbike kits allow you to upgrade an existing bike, which can often be cheaper and more flexible while still being eligible for tax schemes if correctly configured.

Advantages of KirbEbike Kits:

- Fits most bike frames (20", 26", 28", 700C, etc.)

- Fast installation (20–30 minutes)

- Adjustable speed and power for tax compliance

- Free shipping and one-year warranty

Disadvantages:

- Requires DIY installation

- High-powered kits may need manual adjustment to meet tax thresholds

Popular KirbEbike Kits for UK Commuters

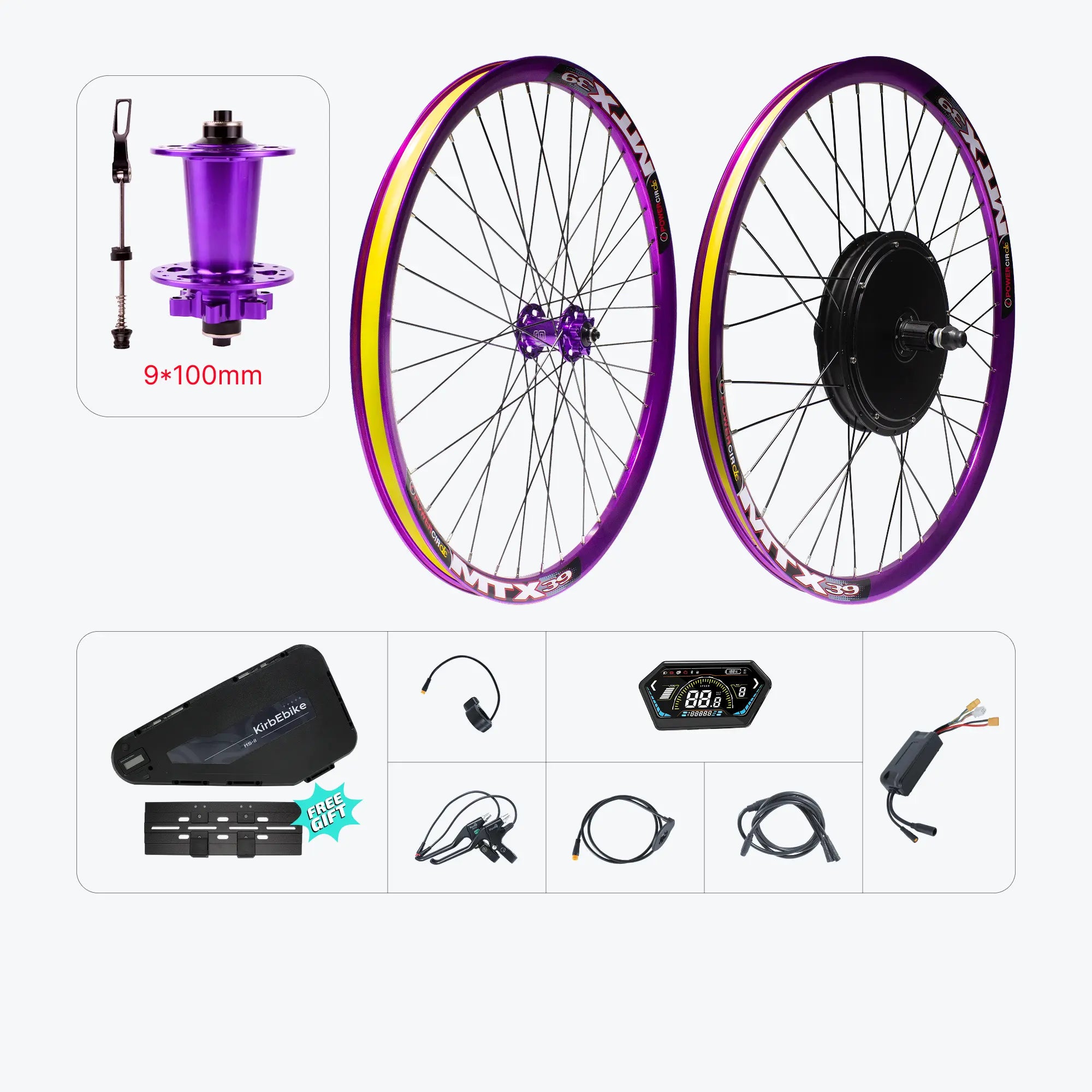

1. KirbEbike 48V 1000W Conversion Kit

- Motor: Brushless 48V 1000W hub motor

- Battery: 48V 16Ah Lithium

- Top Speed: 45–50 km/h (adjustable for UK tax compliance)

- Range: 35–60 km

- Installation: 20 minutes

Advantages: Sleek design, easy installation, pedal-assist ready.

Disadvantages: Max speed requires adjustment for UK tax schemes.

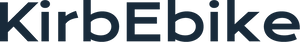

2. KirbEbike 52V 2000W MTX Rim Kit

- Motor: Brushless 2000W rear hub motor

- Battery: 52V 20–30Ah Lithium

- Top Speed: 50–60 km/h

- Range: 40–60 km

- Installation: 30 minutes

Advantages: Powerful, long-range, supports pedal-assist regulation.

Disadvantages: High output requires careful adjustment for tax compliance.

UK Tax Deductible Eligibility Rules

For a KirbEbike conversion to qualify for tax relief under the Cycle to Work scheme, it should:

- Use pedal-assist only

- Have a maximum assisted speed of 25 km/h

- Be used primarily for commuting

Employers often provide guidance and paperwork to ensure compliance. KirbEbike’s customer support can advise on speed limit adjustments and kit selection to meet these requirements.

Maintenance and Compliance Tips

- Battery Maintenance: Charge regularly and follow KirbEbike instructions to ensure longevity.

- Speed Settings: Use the LCD display to cap speed at 25 km/h for tax compliance.

- PAS Usage: Always ride using pedal-assist in restricted areas to avoid breaking tax-deductible conditions.

- Documentation: Keep receipts and specifications from KirbEbike kits as proof for tax submissions.

Frequently Asked Questions

Are electric bikes tax deductible in the UK?

Yes, under certain schemes like Cycle to Work, e-bikes can be tax-deductible if they comply with speed and power limits. Using a KirbEbike conversion kit with regulated pedal-assist ensures eligibility.

Can I use a high-powered e-bike for tax deductions?

High-powered e-bikes (like 1000W+) may need adjustment of speed limits and pedal-assist settings. KirbEbike kits are customizable to meet UK tax rules.

Are KirbEbike conversion kits eligible for tax relief?

Yes, KirbEbike kits can be configured to comply with UK regulations, making them eligible for salary sacrifice schemes. Choose the correct PAS settings and ensure the motor does not exceed 25 km/h in assisted mode.

What documents do I need to claim e-bike tax relief?

Keep receipts, product specifications, and installation instructions from KirbEbike. Your employer may require proof of compliance, including maximum power and speed settings.

How much can I save with a tax-deductible e-bike?

Savings vary by income tax rate. Using a KirbEbike conversion kit under the Cycle to Work scheme can reduce the upfront cost by 25–40%, depending on your tax bracket.

Conclusion

KirbEbike conversion kits provide a flexible, cost-effective solution for riders seeking tax-deductible electric bikes in the UK. By converting your existing bike with high-quality motors, batteries, and PAS systems, you can enjoy the benefits of electric commuting while complying with tax regulations.

Whether you choose the 48V 1000W kit for city commuting or the 52V 2000W MTX kit for longer rides, KirbEbike ensures easy installation, adjustable performance, and compliance guidance for a smooth tax-deductible e-bike experience.